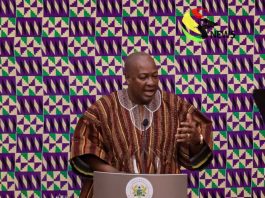

President John Dramani Mahama’s first State of the Nation Address (SONA) since taking office is being billed as a defining moment for Ghana’s economic future, with citizens and stakeholders demanding clarity on his explosive claim that the previous administration “criminally mismanaged” the economy.

As Mahama prepares to speak, pressure mounts to back his allegations with evidence while outlining a credible path to stabilize a nation still reeling from soaring inflation, debt restructuring, and a cost-of-living crisis.

The President’s recent assertion that “Ghana is now a crime scene” has polarized public discourse, drawing skepticism from opponents and cautious optimism from supporters. Analysts argue his speech must move beyond rhetoric to address urgent concerns: double-digit inflation, stagnant job growth, and dwindling investor confidence. With seven weeks in office, Mahama’s National Democratic Congress (NDC) government faces a narrow window to prove its capacity to steer recovery.

Labor unions, a critical support base, are pushing for immediate relief, including a proposed 10% salary increase for public workers and the reinstatement of thousands dismissed under prior austerity measures. Meanwhile, business leaders seek concrete plans to lower borrowing costs and simplify regulations stifling growth. “The private sector needs stability, not political sparring,” said a representative from Ghana’s Chamber of Commerce. “We need clear tax reforms and infrastructure investment to revive productivity.”

The construction sector, a bellwether for economic health, awaits pledges on affordable housing and road projects to unlock jobs. Yet Mahama’s steepest challenge lies in reconciling fiscal discipline with campaign promises of social welfare expansion. Critics warn that unchecked spending risks undermining recent gains from the $3 billion IMF bailout, which stabilized the cedi but deepened public resentment over subsidy cuts and inflation.

Investors, too, are watching closely. Banking reforms following the 2022 financial sector cleanup remain fragile, with lenders hesitant to extend credit amid fears of policy shifts. “The SONA must reassure markets that Ghana won’t revert to erratic decision-making,” noted an Accra-based economist. “Currency stability and debt management are non-negotiables.”

Mahama’s address is also expected to target youth unemployment through digital economy initiatives and agricultural modernization. However, observers caution that structural reforms—like curbing corruption in resource sectors and diversifying exports beyond gold and cocoa—are vital for long-term resilience.

The speech comes amid global scrutiny of Africa’s post-pandemic recoveries, with Ghana positioned as a test case for balancing austerity with growth. Failure to chart a coherent path risks alienating both international partners and a weary electorate. For Mahama, the SONA isn’t just a policy outline—it’s a make-or-break bid to convince Ghanaians that the economy’s “crime scene” can be transformed into a foundation for renewal.