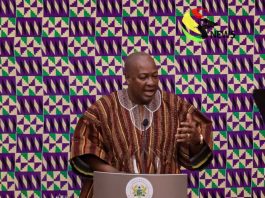

Ghana’s newly sworn-in central bank governor, Johnson Pandit Asiama, wasted no time setting an urgent tone for his tenure, unveiling sweeping reforms aimed at rescuing the embattled Bank of Ghana (BoG) and stabilizing a financial sector still reeling from years of turbulence.

During his inauguration speech on Tuesday, Asiama—a seasoned economist and former deputy governor—pledged to modernize banking regulations, plug gaping holes in the central bank’s balance sheet, and aggressively tackle systemic risks threatening Ghana’s economic recovery. His agenda comes as the BoG itself grapples with a staggering negative equity position of ¢55.8 billion ($4.7 billion), a crisis stemming from massive losses incurred during the country’s recent debt restructuring.

“We cannot preach financial stability while our own house burns,” Asiama declared, drawing murmurs from a room packed with bankers and policymakers. “This institution must lead by example—restoring its equity, tightening oversight, and embracing innovation without compromising prudence.”

Regulatory Reset

At the heart of Asiama’s plan is an overhaul of Ghana’s 2016 banking law (Act 930), which critics say failed to prevent a 2017–2019 sector collapse that saw 420 microfinance institutions and 23 savings-and-loan companies fold. The governor vowed stricter capital adequacy rules and closer monitoring of cybersecurity defenses after a 2023 breach at a major lender exposed data for 200,000 customers.

Non-performing loans (NPLs), which spiked to 20% during the pandemic, remain a key target. Asiama hinted at reviving a dormant credit bureau system to track serial defaulters. “We’ll work with banks to clean their books, but reckless lending ends now,” he said. Analysts note Ghana’s NPL ratio still hovers at 15%—double the sub-Saharan African average.

Central Bank Under the Knife

To fix the BoG’s negative equity—a first in its 66-year history—Asiama announced austerity measures, including staff cuts and a review of “non-core” ventures. Previous attempts failed; the bank lost ¢60.8 billion in 2022 alone, largely from quasi-fiscal interventions like dollar sales to prop up the cedi.

“Negative equity undermines our policy tools,” admitted deputy governor Elsie Addo Awadzi in a recent interview. “If markets doubt our solvency, even rate hikes lose potency.”

Monetary Policy 2.0

Asiama’s boldest gamble involves deploying AI and big data to forecast inflation, which after dipping to 23% in 2023 remains volatile. The move mirrors Kenya’s central bank, which uses machine learning to model food price shocks. Critics, however, question the tech’s reliability in Ghana’s informal-heavy economy.

“AI can’t fix structural issues like fertilizer shortages or smuggling,” argued Accra-based economist Kwame Owusu. “But smarter data could help thread the needle between growth and stability.”

Fintech Frontier

Acknowledging Ghana’s mobile money boom—transactions hit ¢1 trillion ($84 billion) in 2023—Asiama pledged to fast-track regulations for digital assets while expanding rural access. His digital push faces hurdles: a 2023 e-levy on mobile transactions initially crashed volumes, and crypto adoption remains stifled by unclear rules.

“We’ll collaborate with startups, not cage them,” he insisted, nodding to Nigeria’s fintech success. Draft laws for stablecoins and crowdfunding platforms are expected by mid-2025.

Banking veterans recall similar reform pledges after the 2019 sector cleanup, which saw GHC 21 billion ($1.8 billion) spent to rescue collapsed lenders. “Tightening rules is easy,” said former UT Bank CEO Kofi Amoabeng. “The test is whether political will holds when cronies come knocking for bailouts.”

For now, markets respond cautiously. The cedi held steady at ¢13.1/$1 post-announcement, but bond yields barely budged. Economic analysts caution that the central bank’s efforts could falter without parallel fiscal discipline from the government. “Monetary reforms alone won’t stabilize the economy if public spending remains unchecked,” noted a recent IMF report on Ghana’s debt challenges.

As night fell on Accra, street vendors near the BoG’s marble headquarters voiced their own metric for success. “Let him stabilize prices,” said Grace Mensah, selling plantains by lamplight. “My customers don’t care about equity ratios—they just want to afford kenkey again.”